- Trading

- Useful Tools

- About us

- Home

- RoboMarkets FAQ

- Trading FAQ

Trading FAQ

- Why was my position closed at the price, which was not on the chart?Page issue

The charts in the trading terminal are built based on the Bid price, but only long (Buy) positions are closed at the Bid price. Short (Sell) positions are closed at the Ask price.

As a result, your short positions will be closed at the price that is not displayed on the chart until you enable showing the Ask line in the chart settings.

- Why was the order closed without any actions on my part?Page issue

Your position could have been closed due to one of the following reasons:

- The margin level on your trading account reached the Stop Out value.

- The asset price reached the Stop Loss or Take Profit level.

- The Trailing Stop for your position was triggered.

- Why was my order executed not at the declared price?Page issue

Such situations may happen to Buy Stop, Sell Stop, and Stop Loss orders.

When these orders are triggered, the system sends the Market order, which is executed at the current price, which may differ from the declared price.

Other types of pending orders (Buy Limit, Sell Limit, and Take Profit) are mostly executed at the specified price, but sometimes at the better price, if such price exists on the market when they are executed.

- What is leverage?Page issue

The leverage is a ratio between the trader’s own funds and borrowed funds, which a trader borrows from his broker. 1:2 leverage means that for a transaction you must have a trading account with amount 2 times less than the sum of the transaction.

- How does the stop order work? Page issue

The Stop order is a requirement, and when it is met, the platform generates a corresponding order, Market or Limit.

- A Market order is created in case of Buy Stop and Sell Stop orders (orders to buy/sell an asset), and when the asset price reaches Stop Loss level (an order to close the position).

- A Limit order is created in case of Stop Limit order, when the asset price reaches Stop level specified in the order.

- Why can I not sell at the weekend?Page issue

Financial markets are not open on weekends.

- What types of pending orders are there?Page issue

A pending order is the client's order to buy or sell a financial instrument at the specified price in the future.

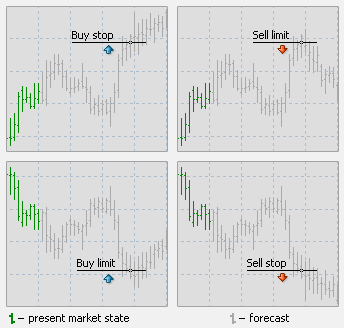

There are four types of pending orders:

Buy Limit — to buy, when the future "Ask" price is equal to the specified value. The current price level is higher than the value of the placed order. Execution of this type of order means that the transaction will be made at the price specified in the order or at the price that is lower. Orders of this type are usually placed in anticipation that the instrument price, having fallen to a certain level, will increase.

Buy Stop — to buy, when the future "Ask" price is equal to the specified value. The current price level is lower than the value of the placed order. Execution of this type of order means that the transaction will be made at the price existing at the moment when the order is executed, which may be different from the price specified in the order. Orders of this type are usually placed in anticipation that the instrument price, having reached a certain level, will keep increasing.

Sell Limit — to sell, when the future "Bid" price is equal to the specified value. The current price level is lower than the value of the placed order. Execution of this type of order means that the transaction will be made at the price specified in the order or at the price that is higher. Orders of this type are usually placed in anticipation that the instrument price, having rising to a certain level, will decrease.

Sell Stop — to sell, when the future "Bid" price is equal to the specified value. The current price level is higher than the value of the placed order. Execution of this type of order means that the transaction will be made at the price existing at the moment when the order is executed, which may be different from the price specified in the order. Orders of this type are usually placed in anticipation that the instrument price, having reached a certain level, will keep decreasing.

Ask

Our consultant will answer your question shortly.